Carve Your Life | Live a Great Life With Dr Prem

Live a Great Life guide is your one-stop resource that helps you make informed life decisions by connecting the dots with comprehensible information in a Guide format.

Let Dr Prem Jagyasi, an award-winning global speaker, Life coach, and bestseller author, along with a prolific team, help you live a great life with inspiring articles, practicable suggestions, useful tips, ideas and amazing hacks on various Life Topics.

Taking their cue from tips and suggestions provided by industry experts, the topics covered include motivation, challenges, inspiration, how to deal with issues, success, opportunities, love, dating and relationships.

Dr Prem Live A Great Life Guide Popular Posts

- All

- Happiness Guide

- Life Challenges Guide

- Live a Great Life Guide

- Passion Guide

- Success Guide

Live A Great Life Guide Latest Posts

Dr Prem Life Guide Popular

The Complete Guide to Quotes in Essays and How to Use Them Correctly

Quotes are an important part of prose composition. They are used to give the reader a sense of what the author thinks or feels about

Dr Prem Life Guide Popular

A guide on how leaders can slow down to achieve success faster

Faster is not always better, it doesn’t take you anywhere. Slowing down helps to lead better and achieve success faster. While this may sound counter-productive,

Dr Prem Life Guide Popular

How to unlock your true potential and live a great life

“Always dream and shoot higher than you know you can do. Do not bother just to be better than your contemporaries or predecessors. Try to

Dr Prem Life Guide Popular

Motivate yourself to do the right thing to live a great life

Hope is being able to see that there is light despite all of the darkness. ~ Desmond Tutu, South African social rights activist and retired

Dr Prem Life Guide Popular

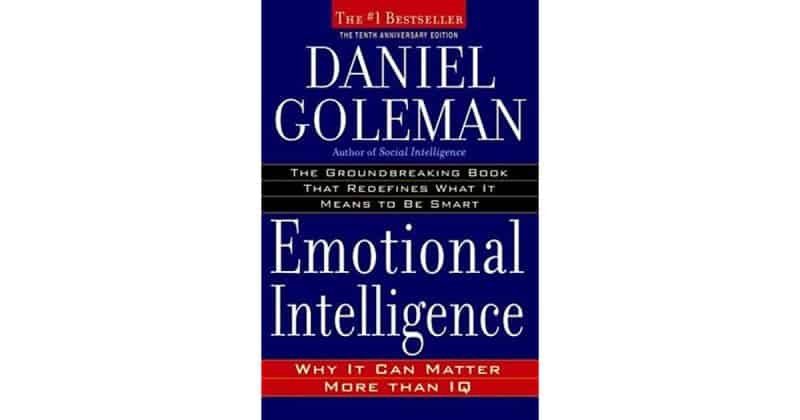

Why should you read and the top books that help you live a great life

The reasons why to read are not limited to 10, but we have compiled and amalgamated the top reasons based on scientific research and common

A Dr Prem Guides and Magazines

Live a great life guide is a part of Dr Prem Guides and Magazines With 50+ niche sites and 5 million monthly readerships, we invite you for Promotion, Review, Ranking and Marketing of your Content, Products and Services. Also connect with us for sale and purchase of websites. Contact Us Now.

Categories

Bestseller Carve Your Life Book