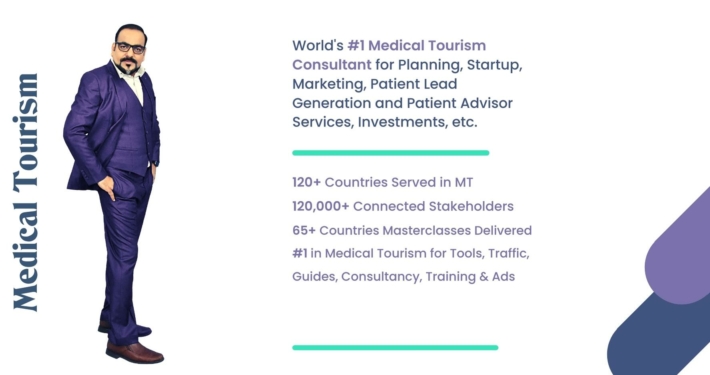

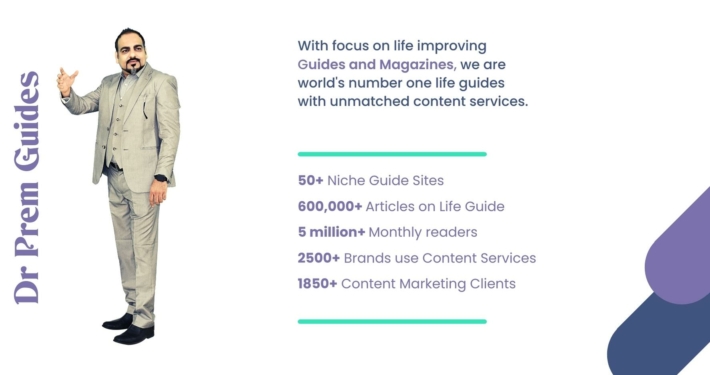

Times Award Winning and Worlds Top – Consultancy, Training, Masterclass, Marketing, Investment & Planning Services in Medical Tourism, Wellness, Wellness Resorts and Global Healthcare Services by Dr Prem Jagyasi. 50+ Guides and Magazines with 5 million monthly page views.

Welcome to Live a Great Life with DrPrem.com.

Rethinking Rage Dr. Prem’s Insightful Perspective on Understanding and Managing Anger

Dr. Prem’s Visionary Speech at Thermal Tourism Conference in Denzli, Turkey Unlocks New Potential of Healing Waters

Experience the Thrill of Adventure Wellness with Dr. Prem’s Pamukkale Gyrocopter Ride!

Wellness in Slovakia: Watch Dr. Prem’s Exclusive Tour of Thermia Palace Ensana’s Unique Thermal Therapies

Linkedin

@in/drprem

Instagram

@drpremj

Facebook

@drpremj

@drpremjagyasi

Twitter

@drpremj

Youtube

c/drprem